Monetization, User Acquisition

What causes user acquisition costs to fluctuate?

Sep 12, 2017

Monetization, User Acquisition

As an app developer, it can be frustrating to see your user acquisition (UA) costs fluctuate from month to month, making it difficult to manage a budget. How can you properly plan your UA strategy knowing costs will not remain consistent?

One common mistake app developers make when calculating UA costs is relying too much on cost per install (CPI). CPI represents just one part of the total acquisition cost that app marketers must take into account. To help move the discussion forward, here’s a look at everything that can, and will, cause user acquisition costs for mobile app users to fluctuate.

Smart marketers begin with the knowledge that they don’t want to acquire every user, just the right users. You find the right users by understanding where they’re coming from. App stores are an obvious consideration, hence the strong focus for many marketers on app store optimization (ASO). But app discovery doesn’t only happen on the app store.

For example, people learn about apps when they’re browsing the web, thumbing through social streams, watching videos, through word of mouth, and from other apps. Search engines in particular are a major part of the discovery, and therefore, the acquisition equation.

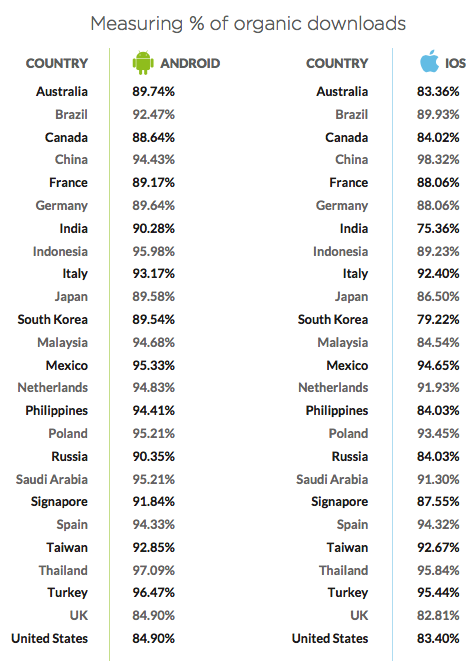

In some categories, search accounts for nearly 60% of app discovery, yet SEO and SEM costs aren’t usually factored into CPI. CPI also doesn’t account for the fact that more than 90% of worldwide app installs are organic, nor does it account the fact that every paid install results in around 1.5 additional organic downloads, according to TUNE.

Image Source: TUNE

Finally, some apps have enough prevalence that they don’t really have to spend to acquire users, whereas apps in other categories must spend big on UA to have even a chance to succeed. Add it all up and it’s clear that CPI alone is not a reliable enough metric for measuring user acquisition costs in many cases.

According to Appboy, if you’re not one of the top 60 apps on the App Store or Google Play, 80-90% of the users you paid to acquire will be gone within 90 days if you do nothing to retain them. The real value of an acquired user will only be measured after they have made it through your on-boarding process and you’ve succeeded in retaining them throughout the first days and weeks after install. To achieve this, you need a great user experience and a solid plan for re-engaging users who drop out during onboarding or lose interest in their initial sessions.

For users you’ve convinced to stick around, you should have the raw data to measure the real cost of acquisition as compared to their lifetime value (LTV), including hard costs for PR, social media marketing, partnership development, direct sales, channel sales, and the costs of acquiring third party data and using programmatic platforms and mediation services.

This number is what you need to use to effectively measure ROI and spend accurately. That’s what happens when you add up the true costs of user acquisition.

In 2015, VentureBeat Insight examined the most effective user acquisition strategies used by app marketers. One clear takeaway is that there is no single UA equation for every app, but there are several common channels for acquiring users that apps employ. These include:

Other channels to keep in mind when calculating total cost of user acquisition are: referrals/incentivized installs, app cross-promotion, and other forms of in-app advertising (e.g. banners, native ads). In each case, it is important for marketers to be able to attribute the cost of utilizing the individual channel to the total expense of acquiring the user and their lifetime value.

While some of the things that confer expense to the process of UA can be distilled down to channels and KPIs, other contributions must be thought of at a more macro level. A user’s geographic location is very important. For example, the cost to acquire an app user in almost any category in Australia is more than it is to get an equivalent user in the USA.

There are also significant differences in user acquisition expenses for app users on iOS devices compared to Android—iPhone users draw a higher CPI. Also, Facebook charges a different rate to reach the same target user than Twitter or Google does.

Another contributing factor to user acquisition cost is something familiar to all marketers: the power of a strong, recognizable brand, which aids with everything from app discovery, to click-through rates on ads and revenue conversion. The size of your existing user base and the relationship they have with your brand is also a factor.

Finally, your app’s total user acquisition expense is inexorably influenced by broader market conditions. This is reflected by the fact that advertisers are putting more and more money into mobile because of the quality audiences it reaches, according to VentureBeat. And when competitors decide to dump more into advertising, your UA costs go up, too.

It’s impossible to boil the cost of user acquisition down to a single metric, or even a single blog post. While it’s exciting to contemplate a less expensive future for UA, it’s more practical to remain focused on optimizing return on investment beyond the point of a simple install.