Performance Marketing

It’s Time for Shopping Apps and Games to Double Down on User Acquisition

Jul 29, 2024

Performance Marketing

About 25% of the average American’s waking hours are spent on mobile apps, a statistic we know and love. These include messaging and social media apps, but gaming and shopping apps are starting to increase their share of the pie.

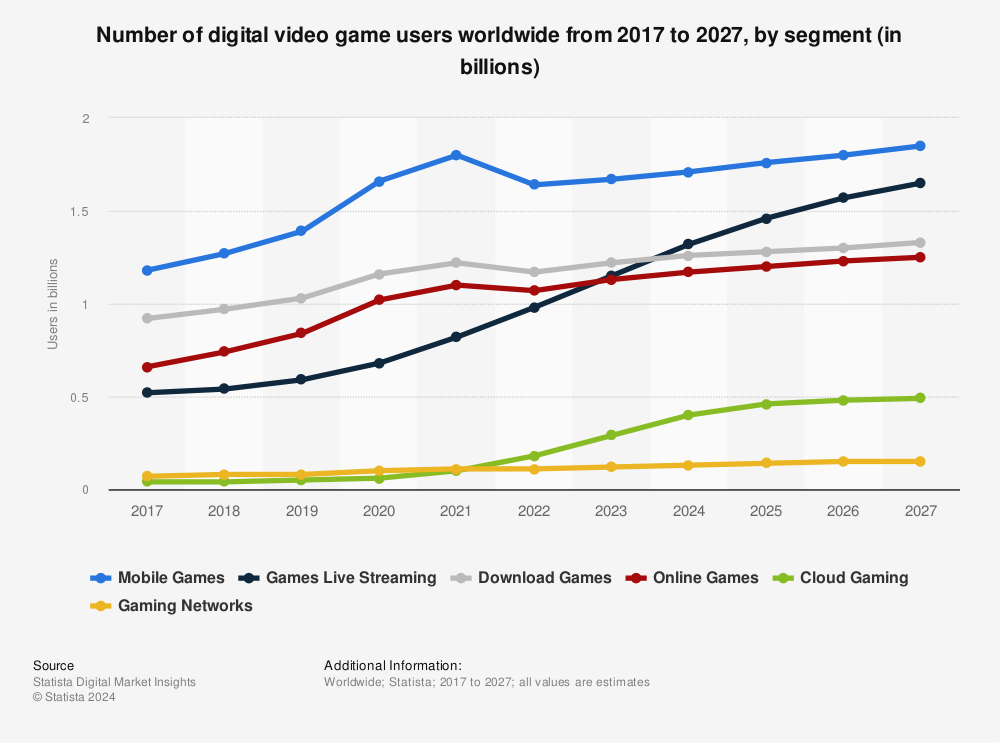

Mobile games are growing in popularity across demographics. If the Wordle sensation didn’t prove the ubiquity of the medium, the market stats, courtesy of Statista, speak for themselves:

The growth in mobile commerce is no less impressive. The pandemic fundamentally changed the way we shop: When stores closed, we went online. And, according to the World Economic Forum, we never looked back. In a PwC consumer insights poll conducted in June of 2023, half of respondents said they’d be increasing their online spending over the next six months, up seven percent from a poll taken six months earlier.

More and more, these e-commerce purchases are happening on mobile devices.

Mobile commerce accounts for a larger share of e-commerce every year and will comprise about 60% of all e-commerce revenue by 2028.

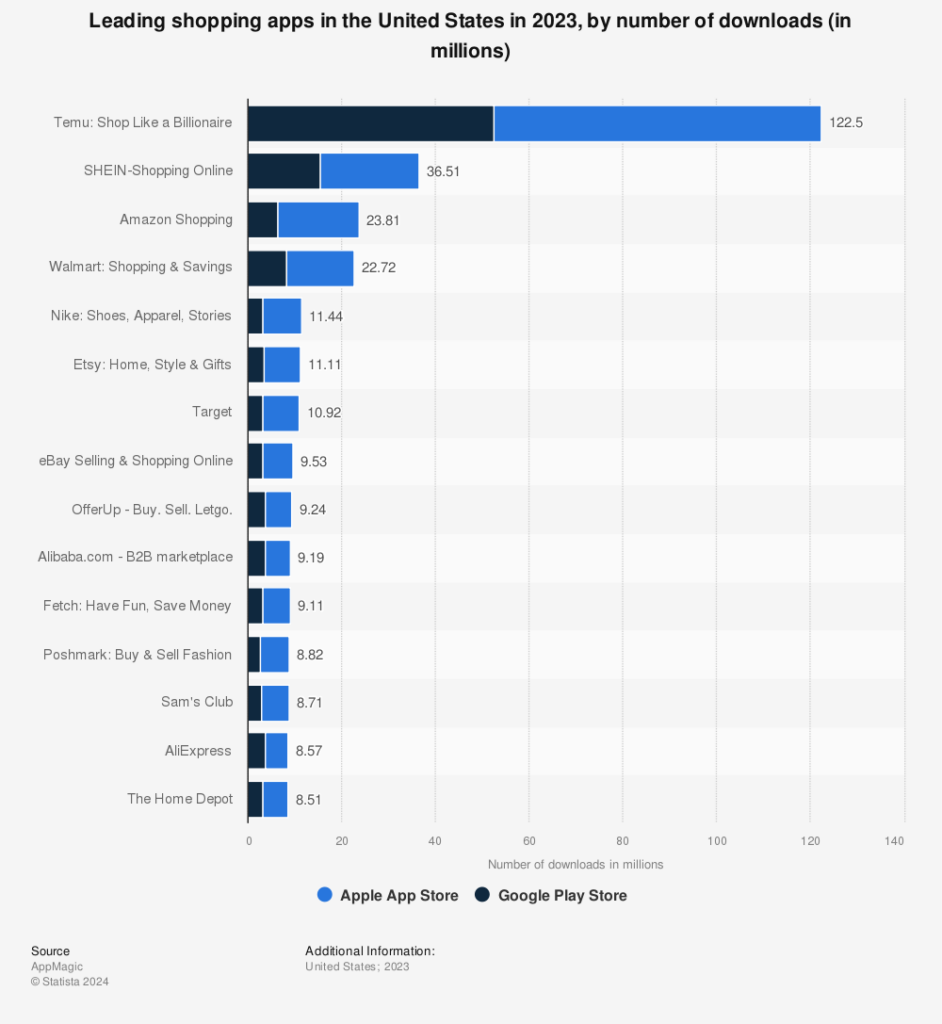

As mobile commerce grows, downloads for shopping apps are also on the rise. While Amazon has a significant head start in the US, China-based Temu and Shein don’t seem daunted by competition. The two bargain-priced retailers began aggressively marketing their apps in the western hemisphere over the last few years and have gained a strong foothold, proving that Americans are increasingly comfortable with in-app purchases.

That said, Americans still lag behind most of the world in mobile shopping.

Source: Business of Apps

Traditional retailers may feel discouraged by the number of shoppers favoring pureplay e-commerce megastores, but their success is good news for the entire industry. While more Americans are downloading and making purchases via shopping apps, many are also embracing the trend toward conscious consumerism, opening the door for brick-and-mortar retailers with both an app and a local footprint. In a recent survey by Nielsen IQ, 78% of consumers stated that a sustainable lifestyle was important to them. McKinsey data supports that research, showing a boost in sales among retailers with ESG claims.

Given this surge in mobile gaming and shopping apps and with growth in both markets expected to continue, user acquisition professionals in both industries should be ready to amp up their marketing efforts.

Gaming is a wildly competitive category that has, due to its accessibility, surpassed other forms of digital video games.

While the market has experienced ups and downs over the past few years, it is improving and stabilizing. Some industry experts believe this could be “The Year of Gaming”—ultimately, the year major advertisers begin seriously investing in mobile advertising, particularly in-game advertising. What seems likelier is that the industry will continue to experience steady, stable growth as brands start to recognize the benefits of in-app advertising.

Regardless of whether or not this is true, both shopping and gaming apps need to focus heavily on user acquisition to maximize growth and revenue.

There are several key trends in UA that can be successfully applied to both app categories.

Understanding your target market based on a detailed analysis of your most profitable projected users is key, as is knowing the competition.

Second, apply your efforts to the channels and tactics that offer the greatest return. There’s no point investing in a CPI campaign in the UK if your average user there has a lifetime value (LTV) that’s a fraction of users elsewhere.

Finally, never forget that user acquisition is a process, not a task. You’ll need to continually optimize your campaigns, test new channels, and experiment with new creatives.

And don’t discount the power of creatives! Good ads are essential, especially in cases where you are running cost-per-install (CPI), cost-per-purchase (CPP), or cost-per-acquisition (CPA) campaigns. Making a strong impression with your ads is not only vital to good UA, but it also has a direct impact on your campaign ROI.

Both shopping and gaming are hyper-competitive app categories. To achieve and maintain success, it’s important to focus on user acquisition tactics and tools that have been proven to engage audiences, earn trust, and drive optimal outcomes.