Gaming, Industry News & Events, Mobile App Growth

India’s Booming Mobile Market Brings Unique Challenges for Marketers

Nov 17, 2017

Gaming, Industry News & Events, Mobile App Growth

In Eric Seufert’s Mobile Dev Memo article, Understanding India’s fast-growing mobile ecosystem, he does a great job of pinpointing the impact of morphing data infrastructure, device markets, and payment mechanisms on India’s large and growing mobile ecosystem—topics AppLovin has previously touched on.

To build on the conversation, I’d like to examine how these technical evolutions may interact with traditional mobile user behaviors in India and empower new ones going forward. Specifically, I’d like to explore how distinct user preferences and cultural norms may challenge developers and marketers to create mobile experiences tailored to Indian users.

While today the typical mobile user in India is young, male, and urban, that’s all changing. By 2020, half of all internet users in India will be rural, 40% will be women, and 33% will be 35 or older, with most skipping over desktop experiences and going straight to mobile. This will significantly alter the nature of mobile markets in India, further challenging developers and brands that already navigate a plethora of technical restrictions to engage and monetize mobile users.

Understand that, in India, apps must be constructed in an extraordinarily lean fashion to work on devices with limited storage (in many cases 16 GB or less). As a result, users there have developed strategies for managing smartphone use that reinforce deeply-rooted behaviors.

Reports show a third of users in India delete apps every day just to create enough capacity to allow their phone to work. This has led to a pronounced preference for “progressive” apps, which allow users to download compressed versions of apps and install them locally on their devices—a far cry from the North American “always connected” state, which allows developers and marketers to dynamically engage users.

The lingering question: Even though more mobile users in India will soon be able to download and use apps the way we in the West do, will they?

It also remains to be seen if users in India will change their preferences for browser-based experiences with progressive web apps as compared to native apps.

Again, there is a reasonable question of whether users in India will eschew this preference going forward or adjust to more hybrid apps, which offer a balance of quality experience and conservative data consumption. These are important considerations for developers and brands seeking to engage Indian users on their own terms.

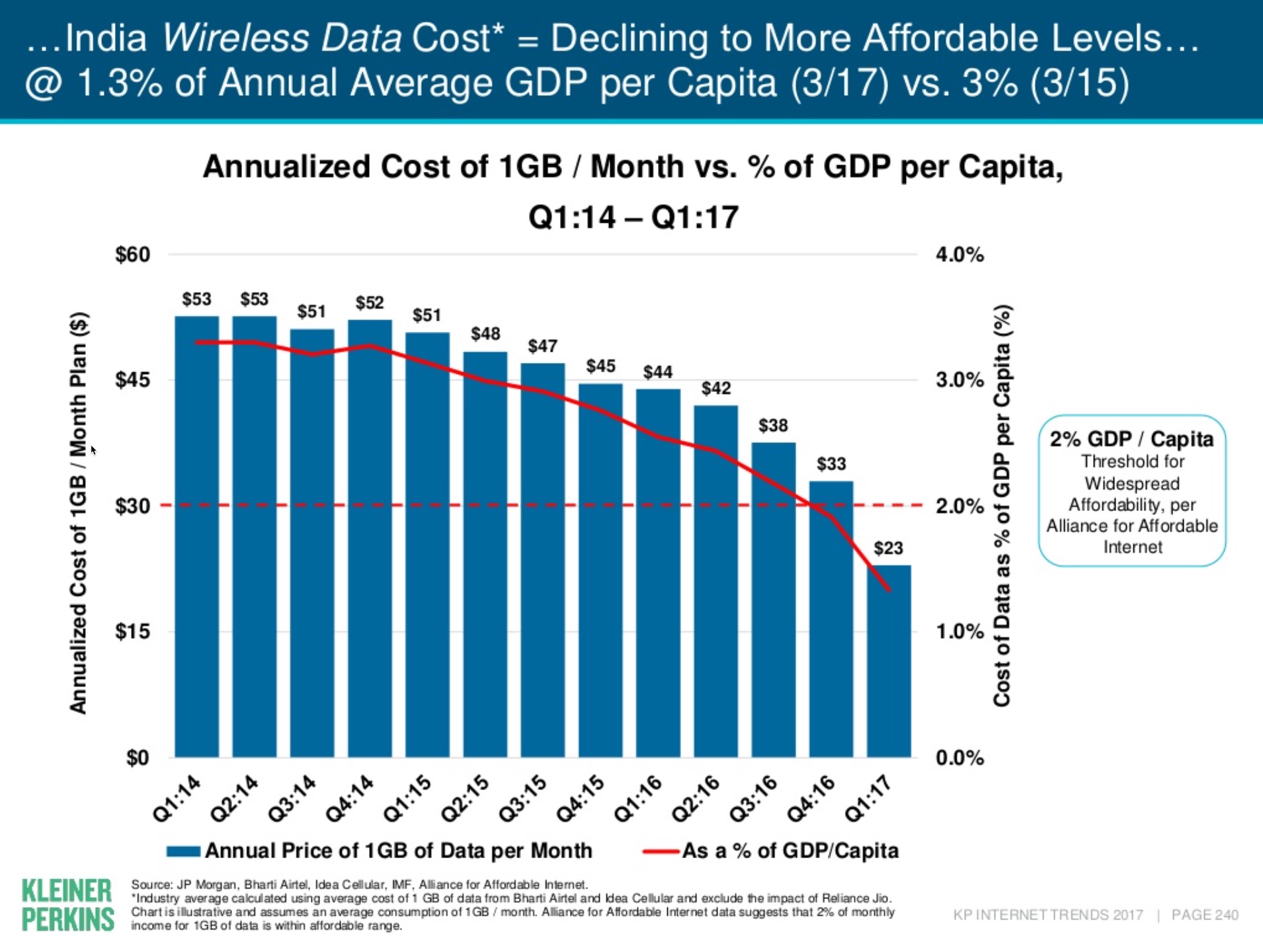

Source: Kleiner Perkins Caulfield Byers

While local brands, including Flipkart, have embraced users’ unique circumstances to offer progressive and browser-based options, it is somewhat more difficult to imagine Western brands making the technical and financial adaptations required to attract, engage, and delight users in a decidedly less omnichannel mobile world. That’s not to say it can’t be done, only that the skills, infrastructure, and marketing tactics required to do so at scale may cause some brands and publishers to abandon the market before they’ve truly entered it.

That would be a shame because Indian mobile users, once engaged, tend to be quite loyal. Here’s what the Boston Consulting Group’s (BCG) says about mobile gamers in its 2017 study Decoding Digital Consumers in India:

“Where mobile game publishers struggle in three quarters of countries, they tend to see higher retention in India. Even for paid user acquisitions, India displays a different pattern from the rest, with 30.1% of Indian users still using the app after 14 days, compared to a global average of 24%.”

“Mobile gaming presents an emerging opportunity for digital advertisers.”

When Indian users are engaged via native apps (the BCG points out that first impressions are very important), the monetization opportunity is good. Likewise, user acceptance of mobile ads is pretty good in India, according to eMarketer:

“Mobile gaming presents an emerging opportunity for digital advertisers, as more than half of respondents (57%) to Tune’s poll said they had previously watched in-game ads in order to access virtual rewards…as data speeds increase and prices fall, rich media ad units like video are likely to proliferate within games.”

But while there are good indicators that native apps can and will break through as India’s mobile ecosystem continues to evolve, there remain many behavioral nuances of local users that will demand creative agility on behalf of developers and marketers, specifically as they relate to payments, security, and differing cultural norms around privacy and device usage.

In India, it’s common for multiple members of the same household to share a single mobile device. This makes privacy control features, such as app locks, must-have considerations for developers.

It also makes personalization difficult because it’s easier for messages and marketing calls to action to miss their intended audience. Less expensive, good quality devices will continue to become more readily available, but it remains to be seen if the shared-device paradigm is something that will change as handsets and data plans become more affordable.

The expectations of Indian users regarding mobile payments are another unique market factor. While they have already embraced the practice of sending money to one another via text messages that contain transaction and authentication information, the actual practice of receiving funds is usually completed via compatible ATMs—quite different than the Western practice of pure electronic transfers.

Will users give up their trusted payment methods for native mobile payment apps?

In a similar vein, payments via e-wallet in physical stores are generally made using a Pay Merchant feature, which relies on the mobile user to enter a PIN that’s provided by an app into a point-of-sale machine. Again, this is a different method than we see elsewhere in the world.

While these may seem like small differences that can be easily upgraded in India’s robust mobile future, transferring funds and making payments in this manner are trusted experiences for mobile users in India. Is it reasonable to believe that India’s estimated 468 million smartphone users by 2021 will opt to give up their current trusted payment methods to adopt native mobile payment systems like Google Pay, Venmo, and PayPal?

Maybe, maybe not.

India is number one source of international migrants, and one in twenty migrants worldwide are born in India—almost 2 million in the U.S. alone. One thing we can say for sure is that however the behaviors of mobile users in India evolve, it is very likely that they will take those behaviors with them as they travel and migrate to other parts of the world.

In the same way that pervasive mobile technologies and norms from the Asia Pacific region are fundamentally shaping the future of mobile commerce in North America with WeChat-styled messaging experiences, Indian users traveling the world will surely bring market shaping behaviors and expectations with them.

What will the impact be on Western markets and how will our own mobile behaviors evolve as a result? These are open questions with many implications we can’t yet understand. I look forward to seeing how things will unfold and how Indian users will help shape the next generation of the world’s mobile experiences.